Description

About Course:

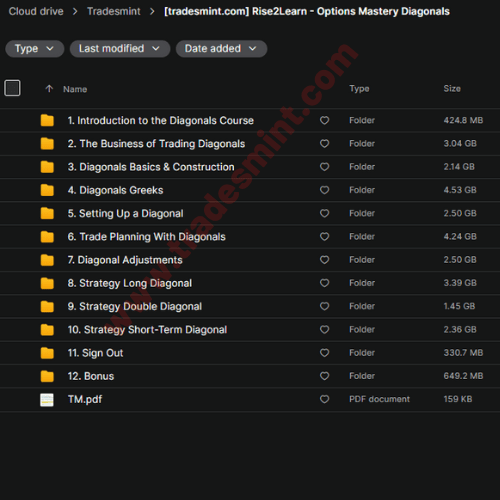

Over 55 videos and 18+ Hours of options diagonals Education

Overview of the Options Mastery #5: Diagonals

The current course length is 18 hours and 41 minutes…

Introduction to the Diagonals Course

- Introduction to Trading Diagonals

The Business of Trading Diagonals

- The Business of Trading Diagonals

- Portfolio Breakdown How & Where Do Diagonals Fit into Your Portfolio

- A $20,000 Portfolio Example Using Diagonals

Diagonals Basics & Construction

- How a Calendar is Similar to a Diagonal

- Diagonal’s basics and how it is Constructed

- Puts vs Calls Using Diagonals Ad Which is Better?

- Variations of Different Diagonals Such as Single, Double, Short, Long, or More Skewed

- Selling Diagonals vs Buying Diagonals and the Risks Involved

Diagonals Greeks

- Understanding the Greeks When Trading Diagonals: Delta

- Understanding the Greeks When Trading Diagonals: Delta Part 2

- Understanding the Greeks When Trading Diagonals: Gamma

- Understanding the Greeks When Trading Diagonals: Theta

- Understanding the Greeks When Trading Diagonals: Vega

- Greeks – Overall Big Picture How They Work Together in a Diagonal Spread

- Greeks Big Picture When Looking on Your Trade Screen

Setting Up a Diagonal

- Delta Neutral Diagonal Setup

- Are You Losing Money on Diagonals and Don’t Know Why?

- The Volatility Advantage to Trading Diagonals

- Why Diagonals are Great Even if You Expect a Pull Back – Part 1

- Why Diagonals are Great Even if You Expect a Pull Back – Part 2

- Why Diagonals are Great Even if You Expect a Pull Back – Part 3

- Why Diagonals are the Most Flexible Strategy When It Comes to Options Trading

- How to Create and Setup a Neutral Diagonal

Trade Planning with Diagonals

- How Much Rotation Should You Give Your Diagonal?

- Diagonal vs Vertical – Which One is Better?

- Double Diagonals vs Iron Condor

- Double Diagonal vs Iron Condor on Screen

- How a Double Diagonal Setup Can Be Negative or Positive Vega

- Finding Good Diagonal Trading Vehicles

- Trading Diagonals on Cheap vs Expensive Stocks

- Creating Hybrid Diagonals and Creative Diagonal Strategies

- Starting a Diagonal Position When the Vex is Low

- Starting a Diagonal Position When the Vex is High

- When to Do Short Duration vs Long-Duration Diagonals

- How Long Should You Hold on to Your Diagonal Trade

- How to Plan and Create a Diagonal Trade

Diagonal Adjustments

- Managing and Adjusting a Diagonal Trade (Where Do You Make an Adjustment?)

- Adjustment Ideas with Diagonals & How to Think About Adjustments

- How to Think About Your Max Profit and Losses After Adjustments

Strategy: Long Diagonal

- Strategy Idea: Long Diagonal for Your Long-Term Investment Portfolio

- Setting Up a Long Portfolio Diagonal Spread on SBUX

- Long Portfolio Diagonal on MCD (Without Protection)

- Long Portfolio Diagonal on JPM (Without Protection)

- Short Portfolio Diagonal on HD

- Strategy Idea: Long Diagonal with Protection

- Long Diagonal with Protection of the SPY During Bearish Markets

Strategy: Double Diagonal

- Strategy Idea: Double Diagonal for Non-Directional Income

- Double Diagonal Trade Example on Disney (DIS)

- Double Diagonal Trade Example on RUT

Strategy: Short-Term Diagonal

- Strategy Idea: Short-Term Diagonal for Protecting Your Portfolio

- Short-Term Diagonal for Protecting Your Portfolio – SPY

- Strategy Idea: Short Term Non-Directional Weekly Diagonal Trade

- Short Term Non-Directional Weekly Diagonal – RUT

Sign Out

- Final Words of Wisdom and Sign Out

Reviews

There are no reviews yet