Description

About Course:

What You Will Learn

- Industry Accounting & Financial Statement Analysi

- Financial Statement Modeling

- Net Asset Value (NAV) and DCF modeling

- Accretion/dilution (M&A) modeling

- Leveraged buyout (LBO) modeling

- Excel mechanics and functionality for the O&G industry

- Comparable company analysis

- Comparable transaction analysis

- Financial & valuation modeling best practices

Introduction to O&G accounting & financial statement analysis

- Participants will understand dynamics of the O&G industry and the factors determining crude oil and natural gas prices

- Learn the different business segments – upstream, midstream, and downstream – that make up the O&G industry

- Learn O&G terminology, units, and key terms

- Distinguish between full-cost and successful efforts accounting methods and their impact on financial statements and on financial statement analysis

- Learn the structure and layout of the O&G financial reports and filings (i.e., 10-K, 10-Q, annual report)

- Learn how to analyse and interpret O&G financial statements, footnotes, and disclosures

- Understand how to perform O&G reserves and production ratio analysis

Introduction to O&G financial modelling

- Building comprehensive O&G financial models from scratch the way it is done at major financial institutions.

- Forecasting crude oil and natural gas prices

- Understanding the role of price and volume hedges

- Standard formatting best practices.

- Excel best practices, efficient formula construction, and appropriate driver selections

- Learning to use data tables to present various sensitivities to projected financial metrics

- Balancing the balance sheet accounts, including excess cash and revolver

- Fixing circularity problems, iteration, and other common modelling troubleshooting

- Balancing sheet / cash flow statement crosschecks

Overview of O&G valuation modelling

- Relative vs. Intrinsic value

- Modelling techniques

- Calculating and interpreting multiples

- Useful Excel shortcuts and functions

- The “football field”

Building an O&G Net Asset Valuation (NAV) model

- Project cash flows for each major project and field to derive the value of E&P segment

- Learn how to value in-ground versus producing reserves

- Understanding proper valuation methodology and drivers for each major O&G business segment

- Estimating the weighted average cost of capital (WACC) and common pitfalls to avoid

- Using data tables to analyse a broad range of scenarios given different assumptions

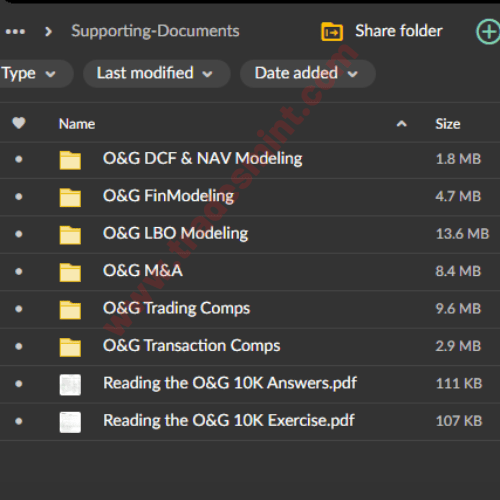

Building an O&G trading comps model

- Set O&G evaluation benchmarks & select comparable companies

- Gather appropriate financial history and projections

- Normalizing operating results and calculating LTM operating results

- Exclude nonrecurring charges, normalize for stock option expense

- Calculate shares outstanding using the treasury stock method

- Input financial data & calculate and interpret financial and market ratios

- Presenting trading comps by structuring output schedule

- Selecting key valuation multiples using the VLOOKUP function and generating multiple tables

Building an O&G transaction comps model

- Similarly, to trading comps, trainees set O&G evaluation benchmarks, select precedent O&G transactions, gather appropriate financial details, input financial data, and calculate and interpret financial and market ratios

- Calculating purchase premiums

- Understanding pricing structures (fixed vs. floating, collars, and walk-away rights)

- Best practices for incorporating synergy assumptions and appropriately calculating unaffected pre-deal share prices

Building an O&G M&A modelling

- Participants will build an O&G merger model in Excel to reflect the pro forma impact of various acquisition scenarios.

- Topics covered include a quick test of accretion-dilution in all-stock deals, pricing structures (exchange ratios/collars/” walk-away” rights), purchase accounting, the step-by-step allocation of purchase price, and the derivation of important O&G metrics and ratios.

Reviews

There are no reviews yet