Description

Description

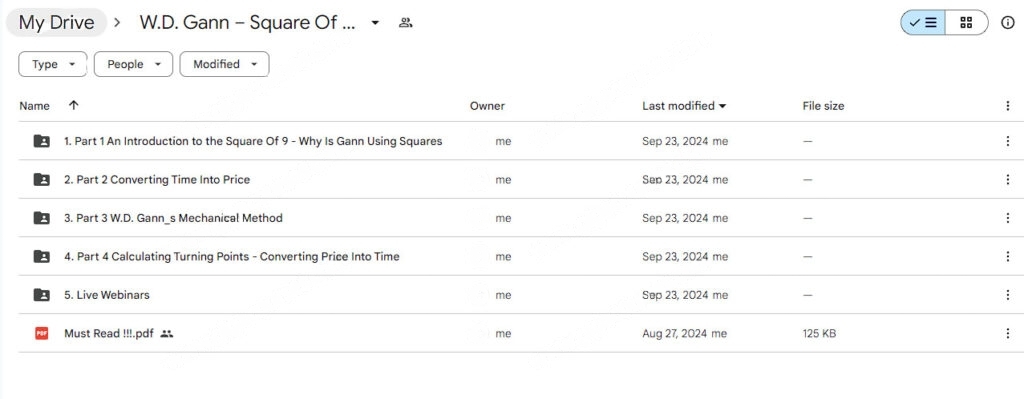

Download Proof | W.D. Gann – Square Of 9 Applied To Modern Markets (7.21 GB)

W.D. Gann – Square Of 9 Applied To Modern Markets

The course W.D. Gann – Square Of 9 Applied To Modern Markets focuses on applying the famous W.D. Gann’s Square of 9 theory to today’s trading environments. Gann’s Square of 9 is a mathematical tool used to predict price movements and time cycles, which has been adapted for modern financial markets in this course.

Key Features

- Introduction to W.D. Gann’s Square of 9

- Overview of the historical significance and development of the Square of 9.

- Explanation of its geometric structure and how it relates to market price action.

- Application in Modern Markets

- Practical insights on using the Square of 9 for analyzing current stocks, forex, commodities, and cryptocurrencies.

- Techniques for identifying key price levels and turning points in volatile markets.

- Time and Price Analysis

- Detailed instruction on using the Square of 9 to predict time cycles and price ranges.

- How to identify critical support and resistance levels using the Square of 9 methodology.

- Customized Trading Strategies

- Tailored strategies for applying Gann’s Square of 9 in day trading, swing trading, and long-term investing.

- Case studies and examples of real-time market application.

- Risk Management Integration

- Learn how to manage risk using the Square of 9’s price forecasting capabilities.

- Methods for setting stops and profit targets based on Gann’s geometric principles.

Benefits of Using the Square of 9 in Modern Markets

- Enhanced Market Forecasting

Traders can predict future price movements more accurately by using this method to uncover hidden market patterns and cycles. - Versatility Across Asset Classes

The course demonstrates how Gann’s principles can be applied across various asset classes, including equities, forex, commodities, and cryptocurrencies. - Improved Timing and Precision

With the ability to predict both price and time cycles, traders can make more informed decisions regarding entry and exit points.

Course Structure

- Module 1: Introduction to W.D. Gann and Square of 9

- History and foundational concepts.

- Understanding the geometric structure of Square of 9.

- Module 2: Price and Time Forecasting

- Identifying price levels using Square of 9.

- Time cycle analysis techniques.

- Module 3: Real-World Applications

- Applying the Square of 9 to current market scenarios.

- Live market examples and walkthroughs.

- Module 4: Advanced Techniques

- Combining the Square of 9 with other technical analysis tools.

- Risk management strategies using Gann’s methodology.

Who Is This Course For?

- Technical Analysts

Traders who already have a background in technical analysis and are looking for advanced tools to improve their accuracy. - Gann Enthusiasts

Those familiar with W.D. Gann’s work and wish to expand their knowledge and apply it to modern-day markets. - Experienced Traders

Traders seeking to refine their market timing and forecasting abilities using time-tested mathematical principles.

Conclusion

The W.D. Gann – Square Of 9 Applied To Modern Markets course offers traders a deep dive into one of the most revered tools in financial history. By applying the Square of 9 in today’s trading environment, students will gain a unique edge in predicting market movements and cycles, enhancing both their accuracy and profitability.

Reviews

There are no reviews yet