Description

In just a few hours you’ll be able to learn and understand many of the financial concepts which have been preventing you from confidently controlling your own investments. You’ll have access to a dozen or so pre-made portfolios which you can potentially start trading immediately. You’ll also be joining an existing private community of hundreds of traders who are already helping each other out and trying to grow together

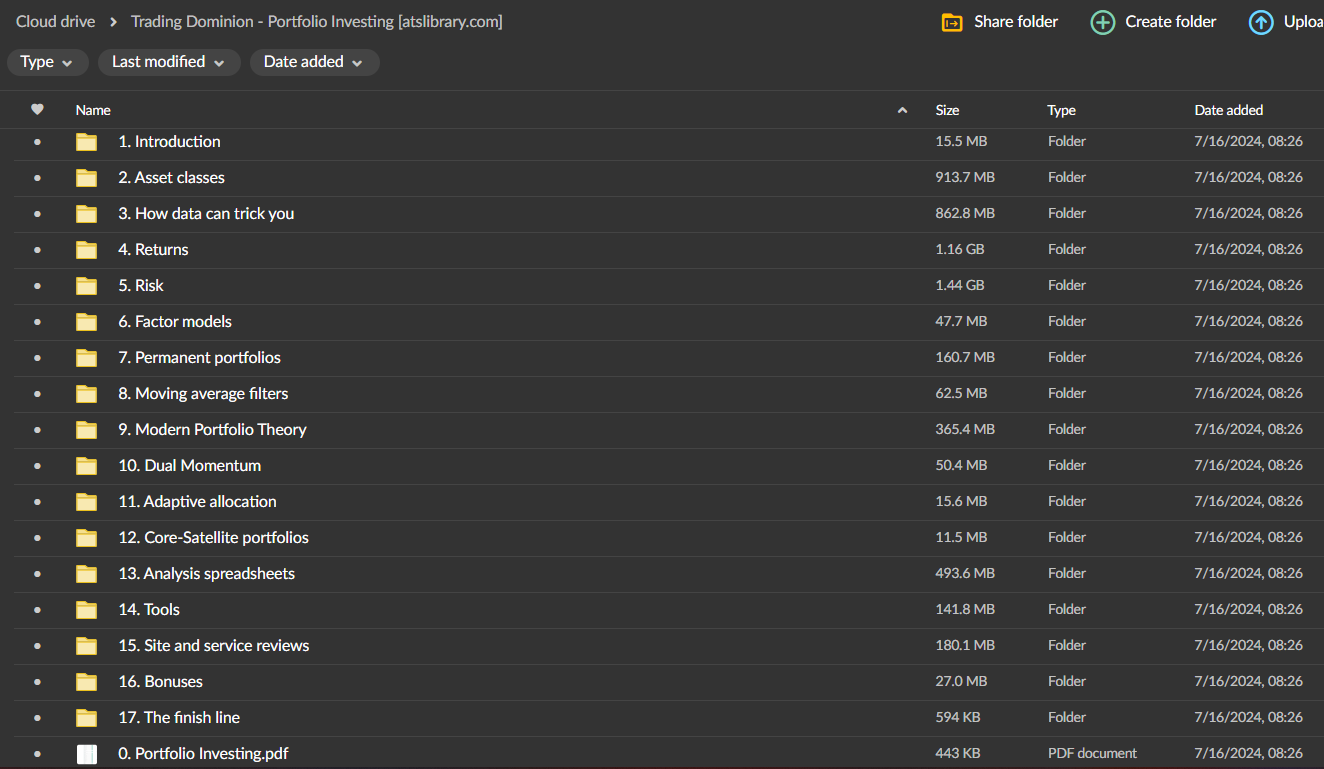

Course contents

Introduction

-

Welcome to the course

-

Strategic versus tactical asset allocation

-

Introduction to bonds

-

Asset classes

-

Hedge funds

-

How data can trick you

Returns

-

Getting historical data

-

Linear versus log scale

-

Arithmetic and log price returns

-

Cumulative arithmetic and log price returns

-

Converting arithmetic and log returns

-

Arithmetic and geometric mean

-

Wealth index

-

Performance charts

Measuring risk

-

Variance and standard deviation

-

The portfolio effect

-

Sharpe ratio, Sortino ratio, Calmar Ratio, Martin Ratio

-

Alpha and Beta

-

Correlation and R Squared

-

Treynor Ratio and Information Ratio

-

Value-At-Risk and Expected Shortfall

Factor models

-

Capital Asset Pricing Model (CAPM)

-

Fama French 3 factor model

Permanent portfolios

-

Equal and Value Weighting portfolios

-

Calculating portfolio returns

-

Review of 5 different permanent portfolios

Moving average filters

-

M.A.F. – single asset

-

M.A.F. – all assets in a portfolio

Modern Portfolio Theory

-

Introduction to MPT

-

Correlation and the correlation matrix

-

Efficient frontier

-

Minimum variance portfolio and mean-variance efficient portfolios

-

Rebalancing

-

Return vs risk graph

-

Capital Allocation Line, and margin effect on returns

-

Kelly Criterion – optimal f

-

Inverse variance portfolio

-

Risk parity portfolio

Dual Momentum

-

Review of 6 different dual momentum portfolios

Other portfolios

-

Review of two Adaptive Allocation portfolios

-

Review of two Core-Satellite portfolios

Reviews

There are no reviews yet