Description

Updated

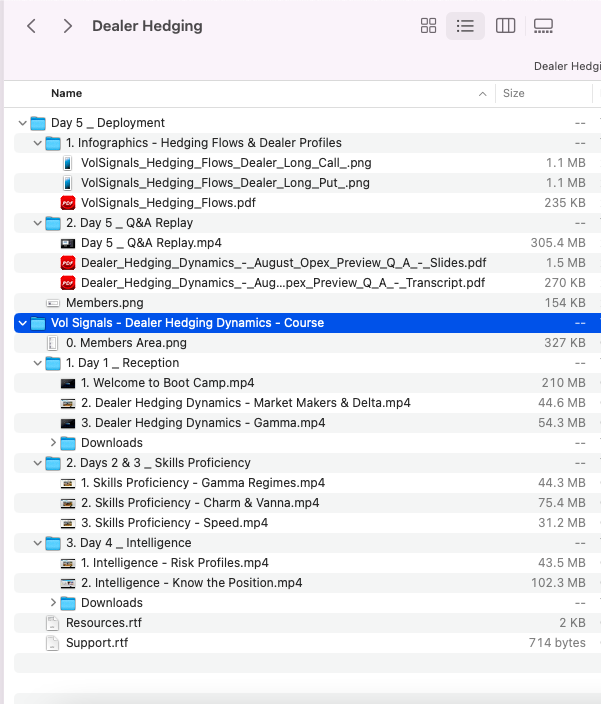

900 MB

With day 5 included.

Dealer Hedging Dynamics Boot Camp by Vol Signals: Master Options Market Mechanics

Introduction to Dealer Hedging Dynamics

The Dealer Hedging Dynamics Boot Camp by Vol Signals provides traders with comprehensive, experience-based knowledge of how institutional options dealers influence market movements. This advanced training program bridges the gap between theoretical options knowledge and practical market applications, delivering actionable insights derived from decades of professional market-making experience.

What Is Dealer Hedging Dynamics Boot Camp by Vol Signals?

The Dealer Hedging Dynamics Boot Camp by Vol Signals is an educational trading program that teaches traders how market makers (dealers) influence price movements through their hedging activities. This specialized training focuses on understanding the mechanics behind institutional trading and how it creates predictable market patterns.

The boot camp is structured over five days and includes a mix of daily videos, live Q&A sessions, and supporting materials to help traders understand critical market concepts like gamma, charm, and vanna. These concepts are explained in practical terms, without overwhelming participants with jargon or complex mathematics. The program aims to equip traders with the skills to predict market movements more accurately by understanding how large institutional players are positioned and how their actions influence market dynamics.

Core Educational Components of the Vol Signals Boot Camp

The Dealer Hedging Dynamics Boot Camp curriculum covers five essential areas:

- Market Structure Fundamentals – Comprehensive exploration of modern options markets with emphasis on institutional dealer positioning

- Dealer Flow Analysis – Advanced techniques for monitoring and interpreting professional hedging activities

- Options Expiration Effects – Detailed examination of how monthly and weekly expirations create predictable market patterns

- Volatility Analysis – Professional methods for using volatility metrics as predictive market indicators

- Practical Trading Implementation – Specific strategies designed to capitalize on dealer hedging patterns with optimal risk management

Core Learning Objectives

In the Dealer Hedging Dynamics Boot Camp, participants will:

- Develop a thorough, intuitive understanding of critical Greek metrics including gamma, charm, and vanna

- Learn professional techniques for analyzing and integrating dealer positioning data into trading strategies

- Acquire proven methods for anticipating market behavior based on institutional options flow

- Master the construction of optimally structured trades that capitalize on dealer hedging patterns

- Implement systematic approaches to maximize trading profits while managing risk exposure

Expert Instruction from a Professional Market Maker

The Vol Signals – Dealer Hedging Dynamics Boot Camp delivers exceptional value through instruction from a veteran market maker with over 40,000 hours of professional trading experience. This provides:

- Real-world trading knowledge based on hands-on market experience rather than academic theory

- Insider perspective from a professional who has actively created and maintained options markets

- Practical wisdom unavailable in conventional trading literature or standard options courses

Practical Application Framework

The Vol Signals Boot Camp transforms complex market concepts into actionable trading knowledge through:

- Simplified explanations of the three KEY Greeks: gamma, charm, and vanna

- Clear methodology for connecting dealer positioning with probable market movements

- Focused content that eliminates unnecessary jargon while emphasizing profit-generating strategies

- Systematic approach to anticipating market direction before significant moves occur

Comprehensive Trading Implementation System

The Dealer Hedging Dynamics Boot Camp by Vol Signals provides complete trading guidance including:

- Precise entry point identification techniques based on dealer hedging patterns

- Step-by-step trade structuring methodologies optimized for current market conditions

- Real-world trading scenario analysis with detailed explanations of market mechanics

- Complete strategic toolkit designed for consistent profitability across various market environments

Reviews

There are no reviews yet