Description

Description

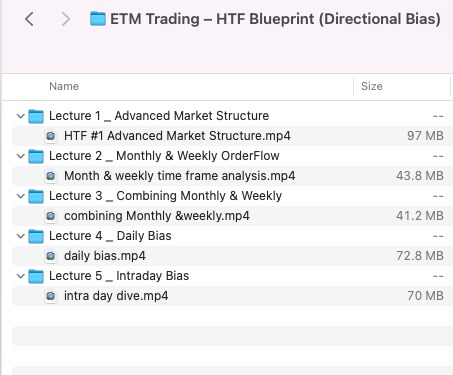

Download Proof | ETM Trading – HTF Blueprint (Directional Bias) (309 MB)

ETM Trading – HTF Blueprint (Directional Bias)

The HTF Blueprint (Directional Bias) by ETM Trading is a premium trading course designed to teach traders how to identify and capitalize on the high-timeframe (HTF) directional bias. Aimed at intermediate to advanced traders, the course promises a deeper understanding of market structure, institutional footprints, and confluence-based trade setups, making it ideal for those looking to refine their edge in the forex and indices markets.

Content Quality and Structure

The course is well-structured, divided into clear modules that progress logically from foundational HTF concepts to actionable trade strategies. Topics covered include:

- Understanding HTF market structure and its impact on intraday moves

- Identifying key supply and demand zones

- Multi-timeframe analysis for directional alignment

- Liquidity sweeps and institutional order flow

- Entry and exit models based on confluence

The explanations are supported with real chart examples, making abstract concepts easier to understand. The video quality is high, and the pacing is deliberate, allowing traders to follow along comfortably.

Teaching Style and Presentation

The instructor adopts a calm, articulate teaching style with a clear focus on clarity and depth. There’s a strong emphasis on mindset and the importance of patience in trading—something often overlooked in strategy-heavy courses.

A standout feature is the constant reinforcement of HTF bias as the anchor for all trading decisions. The instructor doesn’t just tell you what to do but emphasizes the why, which helps build a trader’s independent thinking over time.

What Makes It Unique

- Directional Bias Framework: Unlike many courses that focus purely on indicators or lower-timeframe setups, this course emphasizes directional context from the higher timeframes. This helps avoid “choppy” trades and enhances win rates.

- Institutional Insight: The course incorporates a practical understanding of how institutional players move the market. Traders learn how to anticipate these moves instead of reacting to them.

- Real-World Application: The concepts taught are not just theory. The instructor frequently uses recent market data to illustrate how the framework works in live conditions.

Community and Support

ETM Trading offers a private Discord or Telegram group (depending on the plan), where students can interact with each other and the instructor. Regular updates, trade breakdowns, and Q&A sessions add tremendous value. The community is active, with many members sharing their analysis and growth, which creates a collaborative learning environment.

Pricing and Value for Money

While the course is on the pricier side, it delivers strong value for those serious about leveling up their trading. The HTF directional bias framework alone can be a game-changer, especially when combined with a trader’s existing entry models. For swing traders and funded account aspirants, this course can easily pay for itself if the principles are applied consistently.

Pros and Cons

Pros:

- In-depth HTF market structure education

- Clear focus on institutional logic

- Excellent real-chart examples

- Active support community

- Promotes independent thinking

Cons:

- Not ideal for complete beginners

- Slightly expensive for hobbyist traders

- No “plug-and-play” indicators or shortcuts

Final Verdict

The HTF Blueprint (Directional Bias) course is a high-quality, well-thought-out trading program that delivers exactly what it promises. If you’re looking to build a deeper, context-driven edge in the markets and move away from reactive trading, this course offers a solid foundation.

Reviews

There are no reviews yet