Description

About Course:

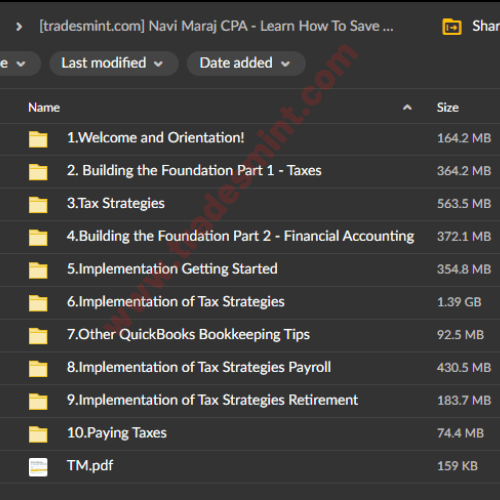

Small Business Taxes From Knowing Nothing to Saving Thousands – Navi Maraj CPA

Course Curriculum:

Welcome and Orientation!

- What Will You Learn?

- How to Use this Course?

- About Me

- Two Disclaimers Before Proceeding

Building the Foundation: Part 1 – Taxes

- Intro to Building the Foundation Part 1

- What Taxes is a Business Subject To?

- Tax Comparison: Employee vs. Sole Proprietor vs. S Corporation

- Marginal & Effective Tax Rate Calculator and Tax Brackets

- What is a Progressive Tax System?

- What is a Marginal Tax Rate?

- What is an Effective Tax Rate?

- The Value of a Tax Deduction

- When To Pay Your Taxes as A Business Owner

- Income Tax Returns for Sole Proprietors & S Corporations

- Please Read: Section Check In

Tax Strategies

- Three Phases of Tax Strategies

- Intro to The Tax Savings Estimator Tool

- Download the Tax Savings Estimator Tool

- Administrative Home Office

- Automobile

- Cell Phone & Internet

- Meals

- Travel

- Hiring Minor Children

- Health Insurance Premiums

- Often Missed Deductions

- Phase 2: Intro to Tax Classification Optimization

- The Difference between Legal Entities & Tax Classifications

- Sidebar: When Does an S Corp Make Financial Sense?

- Salary Optimization and Payroll Matrix

- Access the Payroll Matrix

- Integrating Tax Classification & Salary Optimization into the Tax Savings Tool

- Sidebar: Multi Member LLC (MMLLC)

- Phase 3: Retirement

- How Much Will You Save? (Let me and other students know in the comments.)

- Section Check In

Building the Foundation: Part 2 – Financial Accounting

- Intro to Building the Foundation Part 2

- Overview of the Financial Statements: P&L and Balance Sheet

- The Accounting Equation

- The Chart of Accounts

- Journal Entries, T Accounts and the Accounting Equation

- Putting It All Together

- Section Summary

- Section Check In

Implementation: Getting Started

- Intro to Implementation

- Forming Your Business Entity

- Where to Form Your LLC

- 4 Reasons NOT to be taxed as an S Corp (Give this a read before making the S Corp election for your LLC)

- How and When to Complete a W-9

- QuickBooks Online Discount

- Creating a QuickBooks Online Account

- Overview of QuickBooks Online Menus and Settings

- Customizing the Chart of Accounts in QuickBooks Online

- Linking Your Bank Account to QBO & Capital Accounts Bookkeeping

- Transferring Money to and From Business Accounts

- Section Check In

Implementation of Tax Strategies

- Disclaimer: Tax is Law

- Introduction to The Accountable Plan

- Home Office, Auto, Cell Phone & Internet via the Accountable Plan

- Sidebar: S Corp Home Office

- Sidebar: Auto

- Meals

- Travel

- Hiring Children

- Healthcare Premiums

- Contract Labour

- Business Gifts

- Whoops! I used the wrong account.

- Financial Statements After Recording Expenses

- Bookkeeping for Revenue

- Financial Statements After Recording Revenue

- What is a Reconciliation and How to Reconcile an Account in QuickBooks?

- Section Check In

Other QuickBooks Bookkeeping Tips

- Splitting a Transaction between Business and Personal

- How to Recategorize an Expense?

- Adding an Account or Subaccount to the Chart of Accounts

Implementation of Tax Strategies: Payroll

- Introduction to Payroll Section

- Paying Yourself as a Sole Proprietor

- Paying Yourself as an S Corporation

- Pay stub Walkthrough

- Setting Up Payroll in QBO

- Accounting for Officer Compensation and Non-Officer Wages

- S Corp Owner Health Insurance Tax Savings & Implementation

- Bookkeeping for Payroll in QBO

- Section Check In

Implementation of Tax Strategies: Retirement

- Introduction to Retirement Section

- Questions to Answer Related to Retirement

- Your Retirement Vehicle Options

- The IRA

- The SEP IRA

- The Solo 401(k)

- Where Deductions Will Appear on Your Tax Returns

- Adding Employee Deferral in QuickBooks Payroll

- Bookkeeping for Employee Deferral & Associated Liability

- Section Check In

Paying Taxes

- Intro to Paying Taxes

- Paying Taxes as a Sole Proprietor

- Paying Taxes as an S Corporation

- Paying Taxes as an S Corporation – Bookkeeping & Associated Liabilities

- Section Check In

Reviews

There are no reviews yet