Description

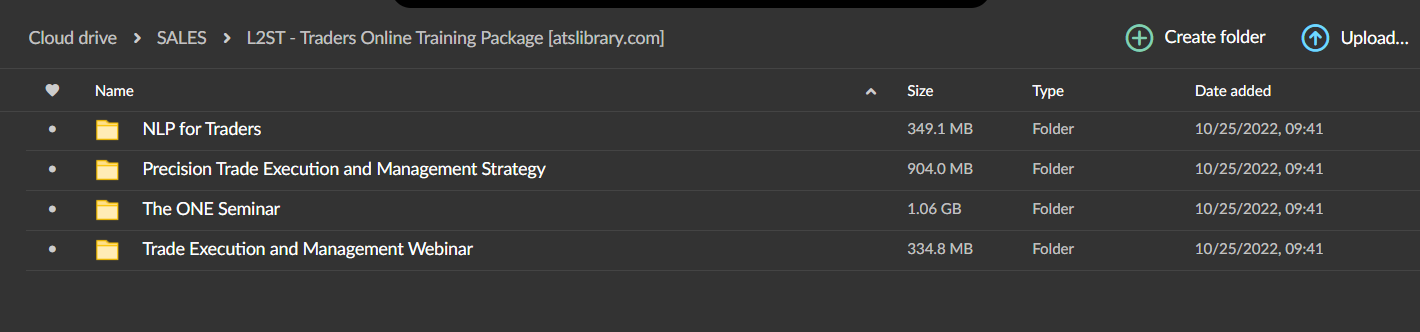

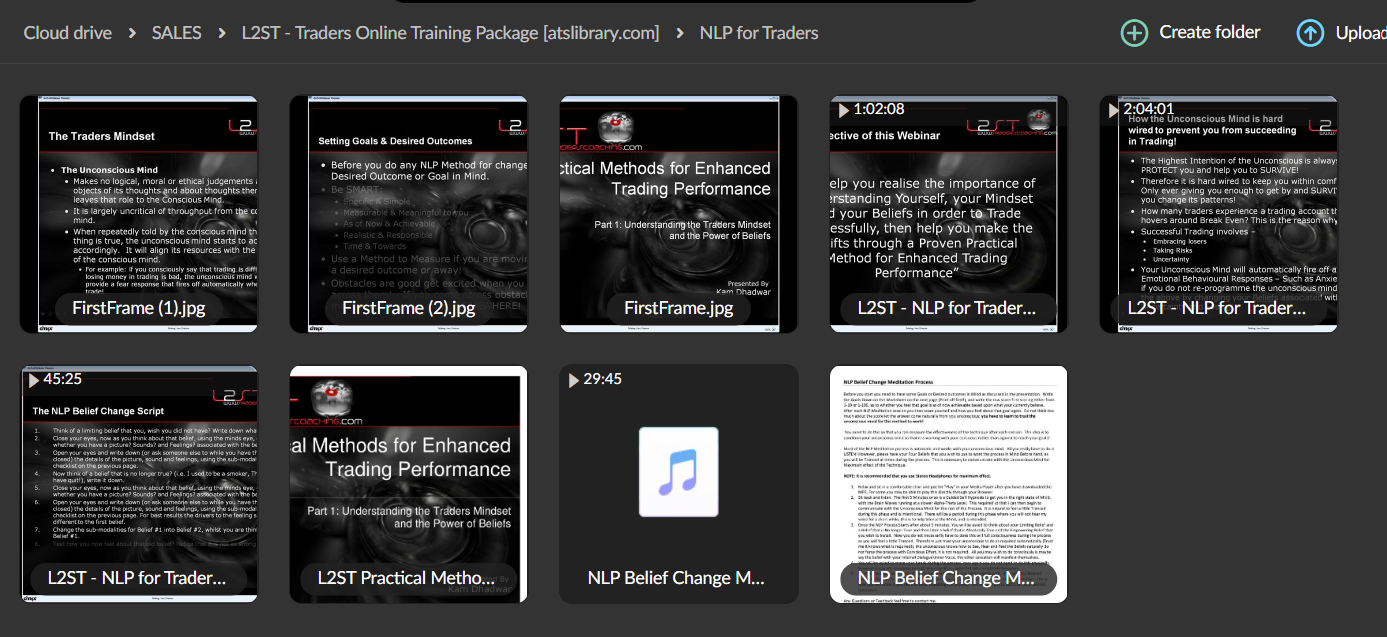

Description of Traders Online Training Package

This Coaching Package includes some of the most UNIQUE methods for trading with Auction Market Theory, VolumeMarket Profile and Order Flow Trading Techniques.

View a SAMPLE from our L2ST Online Training Package below where Kam Dhadwar talks about DOM Analysis which is then followed by a Live Trade taken using TT X Trader on the Emini S&P.

What will you learn in Traders Online Training Package?

Understand the Market Structure and Market Participants Expected Behaviours for the Highest Probability Trades:

- Applying Auction Market Theory and Understanding Market Participants Expected Behaviours.

- Understanding the use of Market and Volume Profile – Reading Acceptance and Rejection of price and how to trade it.

- Learn how to practically trade Intraday Day with the MarketVolume Profile.

- Learn how to identify the most powerful MarketVolume Profile Levels.

- Identifying Value and learning how to use Value for trading.

- Highlighting Developing Structure – Balanced and Imbalanced phases.

- Trading with the VWAP and Developing Value.

Identifying High Probability Trading Opportunities – Learn the Specific L2ST Trade Setups:

- Read price Rejection and Acceptance and understand how to use this for the best trade location and execution that will help reduce risk.

- Identifying and Trading Divergences using the Volume Breakdown – Understand when to use Hidden and Regular Divergence, and know when to ignore divergence!

- Understand how to know in advance when the market is getting ready for a reversal.

- Highlighting Price and Value Relationship Trading Opportunities- Know when to trade which setups with the Art of Adaptive Trading Methodology.

- Trading with an understanding of Volume, Price and Value.

Understanding Risk and Reward Potential in Trades:

- Learn how to determine Predefined Maximum Risk.

- Understand the importance of accepting Risk in Trading.

- Learn the L2ST Risk Management Model for efficient control of Risk and helping identify Position sizes that should be traded.

- Highlighting Risk before entering a trade.

- Highlighting Potential Reward before entering a trade.

- Using Volume Profile Levels for Maximising Profits.

Learn how to Confirm Trade Setups with the Real Time Order Flow and Price Transparency for better Execution:

- Understanding Market Delta Footprints.

- Reading the Depth Of Market (DOM) effectively.

- Reading Pre and post Trade Supply and Demand, and how to use it to confirm trades or ignore trades.

- Understand how to use and trade with BidAsk Volume information.

- How to interpret Developing Delta.

- Learn how to trade Responsive trade and Initiated trade.

Learn the importance of effective Risk and Trade Management:

- Learn how to Manage and Minimising Risk in open trades.

- Learn the Discipline to cut and scratch trades by reading Order Flow.

- Understand how to Scale in and out of trades for effective Risk Management and to maximise profit potential.

Reviews

There are no reviews yet