Description

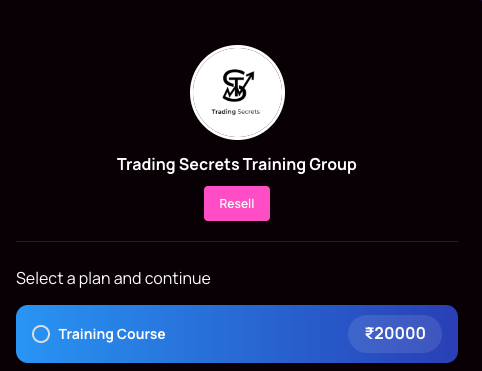

Trading Secrets Training Group Course

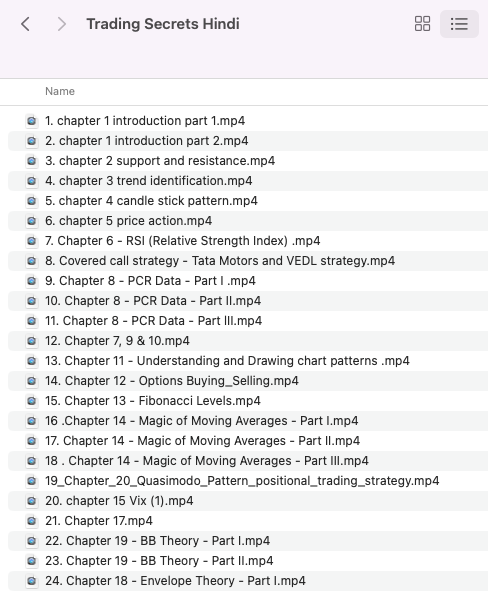

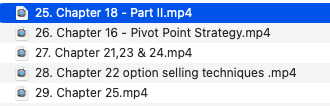

Size:- 27 GB

Language-Hindi

Quality -HD

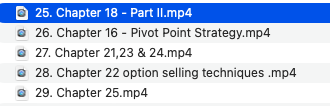

The Course has been designed to impart the basic knowledge towards understanding of market, ability to understand and apply the advanced trading strategies. Course will be covered under the following headings:- 1. Basics of Market Structure (a) Understanding the Indian Market (b) Nifty, Bank Nifty, Fin Nifty, other indices and their relevance (c) Understanding implications of foreign markets on Indian Markets (d) Understanding Worldwide events and their effects on Indian markets (e) Introduction to Futures and Options 2. Movement of market within Support & Resistance levels (a) How to identify Support & Resistance in multi TF (b) Horizontal Support & Resistance (c) Demand & Supply Zone identification and Secrets (d) Static and Variable Support & Resistance (e) Understanding Option Chain 3. Identification of Trends (a) Various types of Trends (b) Trend identification (c) Drawing Trendlines 4. Candlestick/Chart Patterns and their Relevance (a) Formation of Candles (b) Types of Candlestick Patterns (c) Psychology behind every candlestick pattern (d) Entering trade using candlestick patterns (e) Various types of Chart Patterns (f) Relevance of Chart Patterns in Multi TF 5. Identifying Price Action (a) Types of Price Action (Continuation, Reversal, Neutral) (b) Trading using Price Action method (c) Volume Analysis on Daily and Intraday Time frame 6. RSI (a) Study on RSI (b) RSI divergence/Convergence (c) Study on RSI crossovers (d) Relation with underlying derivative (e) Trading with the help of RSI (f) Identification of trend reversal with RSI (g) RSI relevance at different TF 7. Intraday Trading Strategy on 5/15 min charts (a) Inside candle Patterns on different TF (b) Previous days high/low (c) Market Static movement (d) Trading Gap up/gap down (e) BTST/STBT trading techniques (g) Stock Selection for Intraday 8. PCR data (a) Understanding relevance of PCR data (b) Identifying movement of market (c) Applying data wrt underlying derivatives (d) Understanding OI (e) Movement of market as per Multi Strike OI (f) Relevance of FII data (how to predict market as per FII data) (g) Predicting gap up/down (h) Understanding concept of profit booking and Shorts covering (i) Market vs PCR data (j) Relation with Chart Patterns in Multi TF 9. Capital Risk Management (a) Limiting the quantity and trades per day (b) Capital Management (c) Price Behaviour of the underlying asset (d) Relevance of fixing Target in Market 10. Relevance of time in the market (a) When to trade/book SL (b) When not to trade and save SL (c) Intraday movement of stocks as per PCR data 11. Understanding and Drawing chart patterns ADVANCE CHAPTERS 12. Options Buying/Selling (a) Buying/Selling – which is better and Why? (b) Introduction to Hedging (c) Option Selling & Option Buying (d) Introduction of Greeks used in option buying and selling (e) Uses of Sensibull, Opstra, trading Tick etc. 13. Fibonacci Levels (a) Relevance of Fib levels (b) Drawing and understanding Fib levels (c) Relevance of Fibonacci retracement and extension (d) How to use Fib in intraday trading (e) Uses of Fib in long/short term investing & swing trading 14. Magic of Moving Averages (a) Understanding relevance of Moving Averages (b) How to use MA in different TF (c) Identification of Stocks for long term, short term investing and swing trading (d) Intraday Trading Strategies (e) Relevance in all indices (f) Multi TF uses of MA (g) How to time Entry and Exit in stocks (h) Understanding foreign markets wrt MA (i) Gap Up/Down strategies 15. Volatility Index (VIX) (Trading Secret) (a) Understanding relevance of VIX (b) How VIX dominates the entire market (c) When and when not to trade as per VIX (d) Trading as per VIX (e) Determining future market movement (f) Relevance in multi TF 16. Relevance of Pivot Points and associated Trading Strategies 17. Intraday and Positional Futures and Option Strategy using MA, Pivot, RSI and VIX 18. Envelope Theory (Positional F & O trading strategy) 19. How to use Bollinger Bands in trading 20. Quasimodo Pattern positional trading strategy 21. Nifty and Bank Nifty F&O trading in Multi TF 22. Various option selling techniques 23. Option buying strategy in Nifty and BNF only 24. Uses of Super Trend in live market 25. Positional and intraday Option selling strategy in Nifty & BNF only 26. Introduction to taxation – LTCG, STCG, F&O. How to control taxes and repercussions if not done in right way.

Reviews

There are no reviews yet