Description

About Course:

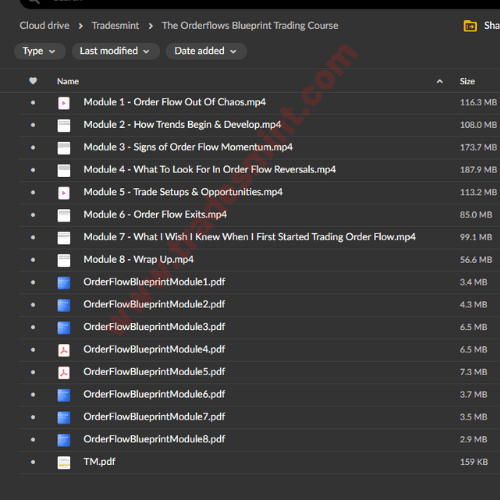

Mike Valtos – The Orderflows Blueprint Trading Course

Module 1 – Order Flow Out of Chaos

Order often arrives out of chaos. Oftentime the market looks chaotic. That is where order flow shines. It allows the trader to see how the current trading is taking place and identify specific activity taking place.

Module 2 – How Trends Begin & Develop

It is fascinating how trends begin and develop in the market. Understanding how trends begin and develop can provide greater insight into what can happen next in the market. By taking an in-depth look into how trends start, traders will gain invaluable insight into the market and the chance to participate in the trend as early as possible.

Module 3 – Signs of Order Flow Momentum

The early signs of order flow momentum can be extremely rewarding to catch: they allow traders to detect the direction a market is headed before other traders. Being able to recognize these signs can give even the newest of traders an edge over those who don’t recognize the order flow dynamics taking place.

Module 4 – What to Look for In Order Flow Reversals

If you are looking for reversals in order flow, there are a few key elements to monitor. Volume is a major part of the equation and can tell you when a market has reached its peak. Analyzing both the bid-ask spreads and price levels reveal useful information when a reversal is taking place. By recognizing when extreme levels have been reached and continuing to monitor order flow behavior, traders can often benefit from potential reversals starting.

Module 5 – Trade Setups & Opportunities

Learn to identify and take advantage of specific momentum and reversal trade setups in the order flow. Momentum trading is all about staying ahead of the order flow. Not only do successful momentum traders need to identify opportunities, but also be ready to jump on them in a split second. Momentum and reversal trade setups are an essential part of any trader’s toolbox.

Module 6 – Order Flow Exits

Being a successful trader requires not only knowing when to enter a trade, but especially when to exit it. Nobody wants to take a loss greater than necessary and that is why knowing when to exit the trade is so important. Traders should always have an exit plan for each trade and adjust it as the market conditions change.

Module 7 – What I Wish I Knew When I First Started Trading Order Flow

As a former institutional trader, I look back on my early days of trading order flow with a mix of nostalgia and amusement. Looking back, there were so many things I wish I had known. When I first got started, there was so much to learn about reading the buying and selling pressure in the market. Of course, it took me some time to adjust and understand how market orders moved the price and how liquidity affected price movement. Through understanding the intricacies of order flow trading, I began to recognize low-risk entry points that created opportunities.

Module 8 – Wrap Up

This final module wraps up the whole course and serves as a comprehensive review of everything you have learned. By now, your knowledge has vastly increased and that you are well-equipped to apply lessons learned in this course to further your trading abilities with order flow. Do not forget that knowledge is power, so make sure you use that power to its fullest potential.

Reviews

There are no reviews yet