Description

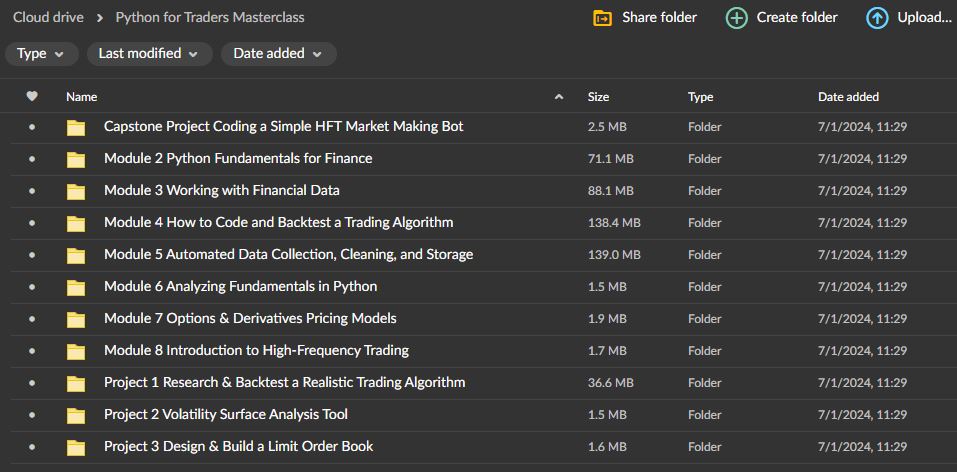

Python for Traders Masterclass 2024 Download

Python for Traders Masterclass 2024 | Size: 484 MB

About Course:

The Python for Traders Masterclass

8 Modules

4 Projects

105 Lessons

248 Code Examples

34 Hours of Content

Module 1: Introduction

- 1.1. Welcome to the Python for Traders Masterclass(2:14)PREVIEW

- 1.2. Why learn to code as a trader?(7:15)PREVIEW

- 1.3. Why should traders learn Python?(4:23)PREVIEW

- 1.4. What will I gain from this course?PREVIEW

- 1.5. What topics will be covered?PREVIEW

- 1.6. Who is the intended audience for this course?PREVIEW

- 1.7. How much finance knowledge do I need?(1:40)PREVIEW

- 1.8. How much coding knowledge do I need?(1:37)PREVIEW

- 1.9. Placement Quiz: Am I a good fit for this course?PREVIEW

- 1.10. Module QuizSTART

Module 2: Python Fundamentals for Finance

- 2.1. Python Installation and SetupSTART

- 2.2. Running Python CodeSTART

- 2.3. Basic Python(26:34)START

- 2.4. Intermediate Python(5:07)START

- 2.5. Advanced PythonSTART

- 2.6. Data Science in PythonSTART

- 2.7. Key library: PandasSTART

- 2.8. Key library: NumPySTART

- 2.9. Key library: MatplotlibSTART

- 2.10. Key library: StatsmodelsSTART

- 2.11. Key library: Scikit-learnSTART

Module 3: Working with Financial Data

- 3.1. Introduction to Financial Data: Time Series and Cross-SectionsSTART

- 3.2. Data Acquisition and Cleaning(18:09)START

- 3.3. Time Series Analysis(13:38)START

- 3.4. Understanding Stationarity(11:55)START

- 3.5. Time Series ForecastingSTART

- 3.6. Exploratory Data AnalysisSTART

- 3.7. Section summarySTART

Module 4: How to Code and Backtest a Trading Algorithm

- 4.1. So what is a trading algorithm?START

- 4.2. Algorithm Design PrinciplesSTART

- 4.3. Data Management Module(15:12)START

- 4.4. Signal Generation Module(15:12)START

- 4.5. Risk Management Module(10:58)START

- 4.6. Trade Execution Module(10:27)START

- 4.7. Portfolio Management Module(11:05)START

- 4.8. Backtesting BasicsSTART

- 4.9. Backtesting SoftwareSTART

- 4.10. Advanced Backtesting TechniquesSTART

- 4.11. Optimization and Parameter TuningSTART

Project 1: Research & Backtest a Realistic Trading Algorithm

- Project Overview(6:57)START

- Step 1: Getting Started on QuantConnect(6:53)START

- Step 2: Formulate a StrategySTART

- Solution: Formulate a StrategySTART

- Step 3: Develop the AlgorithmSTART

- Solution: Develop the AlgorithmSTART

- Step 4: Run a Backtesting AnalysisSTART

- Solution 4: Run a Backtesting AnalysisSTART

- Project SummarySTART

Module 5: Automated Data Collection, Cleaning, and Storage

- 5.1. Sourcing financial data(5:38)START

- 5.2. Working with CSVsSTART

- 5.3. Working with JSONSTART

- 5.4. Scraping data from APIs(51:35)START

- 5.5. Scraping data from websitesSTART

- 5.6. Persisting data: files and databasesSTART

- 5.7. Section summarySTART

Module 6: Analyzing Fundamentals in Python

- 6.1. Structured vs. Unstructured DataSTART

- 6.2. Types of Fundamental DataSTART

- 6.3. Gathering & Cleaning Fundamental DataSTART

- 6.4. Automated Screening & FilteringSTART

- 6.5. Statistical Analysis of Fundamental DataSTART

- 6.6. Natural Language Processing on News ArticlesSTART

- 6.7. Natural Language Processing on Annual ReportsSTART

- 6.8. Using LLMs for Natural Language ProcessingSTART

Module 7: Options & Derivatives Pricing Models

- 7.1. Introduction to Options & DerivativesSTART

- 7.2. Basics of Option PricingSTART

- 7.3. The Binomial Options Pricing ModelSTART

- 7.4. The Black-Scholes-Merton ModelSTART

- 7.5. Monte Carlo Simulation for Option PricingSTART

- 7.6. Introduction to Exotic OptionsSTART

- 7.7. Interest Rate Derivatives and Term StructureSTART

- 7.8. Implementing Finite Difference Methods for Option PricingSTART

- 7.9. Volatility and Implied VolatilitySTART

- 7.10. Advanced Topics and Modern Developments (Optional)START

Project 2: Volatility Surface Analysis Tool

- Project OverviewSTART

- Step 1: Fetching Options DataSTART

- Solution: Fetching Options DataSTART

- Step 2: Calculating Implied VolatilitiesSTART

- Solution: Calculating Implied VolatilitiesSTART

- Step 3: Plot a 3D Volatility SurfaceSTART

- Solution: Plot a 3D Volatility SurfaceSTART

- Project SummarySTART

Module 8: Introduction to High-Frequency Trading

- 8.1. What is High Frequency Trading (HFT)?START

- 8.2. Handling High-Frequency Tick DataSTART

- 8.3. Latency Measurement and SimulationSTART

- 8.4. Understanding the HFT Market Making StrategySTART

- 8.5. Understanding Statistical Arbitrage with High-Frequency DataSTART

- 8.6. Signal Processing for HFTSTART

- 8.7. Real-time News ProcessingSTART

- 8.8. Section summarySTART

Project 3: Design & Build a Limit Order Book

- Project OverviewSTART

- Step 1: Design the Data StructureSTART

- Solution: Design the Data StructureSTART

- Step 2: Add FunctionalitySTART

- Solution: Add FunctionalitySTART

- Step 3: Simulate Live OrdersSTART

- Solution: Simulate Live OrdersSTART

- Project SummarySTART

Capstone Project: Coding a Simple HFT Market Making Bot

- Project OverviewSTART

- Step 1: Define a System and Class ArchitectureSTART

- Solution: Define a System and Class ArchitectureSTART

- Step 2: Define the Event LoopSTART

- Solution: Define the Event LoopSTART

- Step 3: Implement the Data FeedsSTART

- Solution: Implement the Data FeedsSTART

- Step 4: Implement the Order ManagerSTART

- Solution: Implement the Order ManagerSTART

- Step 5: Add Alpha to the Pricing StrategySTART

- Solution: Add Alpha to the Pricing StrategySTART

- Project SummarySTART

Reviews

There are no reviews yet