Description

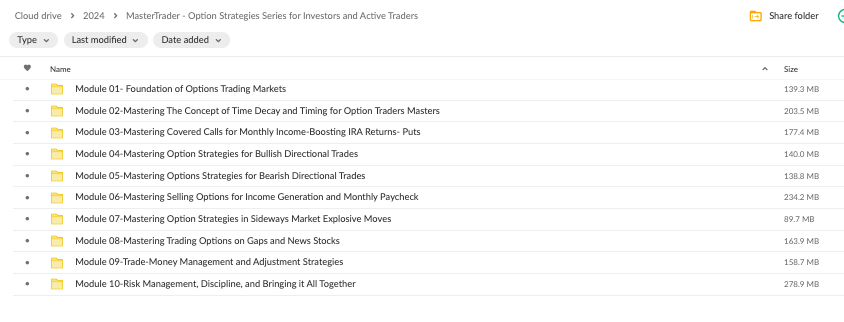

MasterTrader – Master Trader Option Strategies

I. Foundation of Options Trading and Markets

Introduction to Options

Call and Put Options and When Used

Understanding Option Terminology and Quote Screen

Using Technical Analysis With Option Trading

III. Mastering Covered Calls for Monthly Income and Boosting Returns

Covered Calls Defined and Risk Graph

Buying Covered Calls as Mildly Bullish Directional Trade

Selling Calls Against Holdings for Income

Selling Calls Against Holdings to Reduce Cost Basis

Selecting Optimal Strike and Expiration

Buying Covered Puts as Mildly Bearish Directional Trade

V. Option Strategies for Bearish Directional Trades

Buying Puts as Bearish Directional Trade

Selecting Optimal Strike and Expiration

Bear Put Spreads as Mildly Bearish Directional Trade

Bear Diagonals as Bearish Longer Term Directional Trade

Management Strategies

VII. Option Strategies in Sideways Markets and Explosive Moves

Short Straddles and Strangles

Long Straddles and Strangles

Short Iron Condors for Range Bound Markets

Iron Butterflies

Numerous Examples, Plus Management Strategies

IX. Trade/Money Management and Adjustment Strategies

Money Management

Adding or Adjusting Positions as Bias Changes

Legging Into Iron Condors

Defensive and Offensive Rolling Techniques

Rolling Option Strikes Up/Down as Bias Changes

Rolling Option Expiration Up/Down as Bias Changes

Repair Strategies

II. Basics of Time Decay, Volatility, and Timing for Option Traders

Options Pricing and the “Greeks”

How Theta (Time Decay) Provides Edge to Option Sellers

VIX (“Fear Index”), High IVR, and Timing for Option Sellers

Normal Distribution and Probability of Profit

IV. Option Strategies for Bullish Directional Trades

Buying Calls as Bullish Directional Trade

Selecting Optimal Strike and Expiration

Buying Bull Call Spreads as Mildly Bullish Directional Trade

Buying Bull Diagonals as Bullish Longer Term Directional Trade

VI. Selling Options for Income Generation and Paycheck

Selling Naked Puts

Selecting Strike Price/Expiry

Selling Bull Put Spreads

Selling Naked Calls

Selling Bear Call Spreads

Numerous Examples, Plus Management Strategies

VIII. Trading Options on Gaps and News Stocks

Trading News

Trading Gaps

Pro Gaps

Novice Gaps

High IVR Patterns

X. Psychology, Trading Plan, Miscellaneous, and Bringing it All Together!

Discipline/Psychology

Trading Plan

Miscellaneous Topics

Review of Strategies in 4 Stages

Test Your Knowledge

Concluding Thoughts and Next Steps!