Description

LIT Trading – Adventure (Algo Concepts) Download

LIT Trading – Adventure (Algo Concepts) | Size: 14.69 GB

About Course:

LIT Trading’s Adventure (Algo Concepts) course is a specialized program designed for traders looking to delve into algorithmic trading. The course offers comprehensive insights into the world of algorithmic strategies, focusing on developing and implementing trading algorithms that can enhance trading efficiency and profitability.

Liquidity Inducement Theorem Wake up, your journey begins

Key Modules

- Day 1: Your Journey Begins

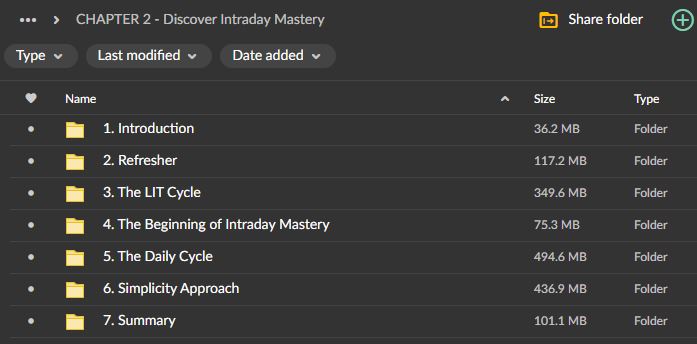

- Day 2: Discover Intraday Mastery

- Day 3: Explore Intraday Mastery

- Day 4: Understand Intraday Mastery

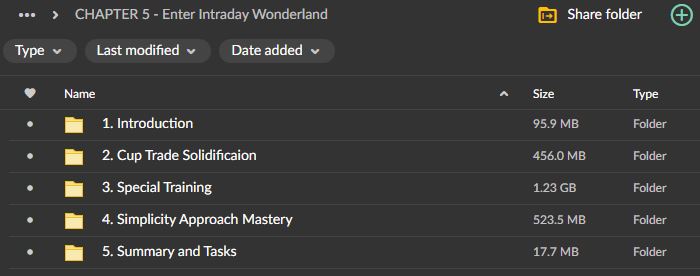

- Day 5: Enter Intraday Wonderland

- Day 6: Construct Intraday Mastery

- Day 7: Study Intraday Mastery

- Day 8: Master Intraday Mastery

Please note, this is only the 8 chapter adventure

Course Objectives

- Understanding Algorithmic Trading: Gain a foundational understanding of what algorithmic trading entails, including the core principles and benefits.

- Developing Trading Algorithms: Learn how to develop trading algorithms that can be applied to various financial markets.

- Risk Management Techniques: Explore advanced risk management strategies specific to algorithmic trading.

- Real-World Applications: Apply the learned concepts in real-world trading scenarios to understand their practical implications.

Introduction to Algorithmic Trading

- Overview of Algo Trading: Definition, history, and the evolution of algorithmic trading.

- Types of Trading Algorithms: Explanation of different types of algorithms (e.g., trend-following, mean reversion, arbitrage).

- Benefits and Challenges: Analyzing the advantages and potential risks associated with algorithmic trading.

Algo Development Basics

- Algorithm Design: The fundamentals of designing a trading algorithm, including logic, rules, and conditions.

- Backtesting Strategies: Techniques for backtesting algorithms to assess their effectiveness.

- Coding Basics: Introduction to programming languages commonly used in algo trading (e.g., Python, R).

Advanced Algo Concepts

- Machine Learning in Trading: Application of machine learning techniques to develop predictive trading models.

- High-Frequency Trading (HFT): Exploration of high-frequency trading strategies and their implementation.

- Data Analysis and Mining: Techniques for data mining and analysis to inform trading decisions.

Risk Management and Optimization

- Risk Assessment Techniques: Methods for evaluating and managing the risk associated with algorithmic strategies.

- Portfolio Optimization: Strategies for optimizing a portfolio using algorithmic methods.

- Drawdown Management: Techniques for managing drawdowns and minimizing losses.

Learning Outcomes

By the end of this course, participants will:

- Have a strong understanding of the foundational concepts of algorithmic trading.

- Be capable of designing, backtesting, and implementing their own trading algorithms.

- Understand advanced topics like machine learning applications and high-frequency trading.

- Be proficient in managing risks associated with algorithmic strategies.

Conclusion

The Adventure (Algo Concepts) course by LIT Trading is an excellent opportunity for individuals eager to explore the dynamic world of algorithmic trading. With a mix of theoretical knowledge and practical application, this course equips traders with the tools and techniques needed to succeed in modern financial markets.

Reviews

There are no reviews yet