Description

AlgoTrading101 Courses Download

AlgoTrading101 Courses | Size: 7.05 GB

About Courses:

AlgoTrading101 Course Syllabus

AlgoTrading101 consists of 2 main courses:

- AT101: Algorithmic Trading Immersive Course

- PT101: Practical Quantitative Trading with Python Masterclass

AT101 focuses on the fundamentals of trading strategy design, testing and execution.

PT101 focuses on modern and more advanced strategies such as:

- Obscure markets like Canadian bond STIR futures

- Multi-asset strategies

- Alternative data

- Web scraping

- Machine learning

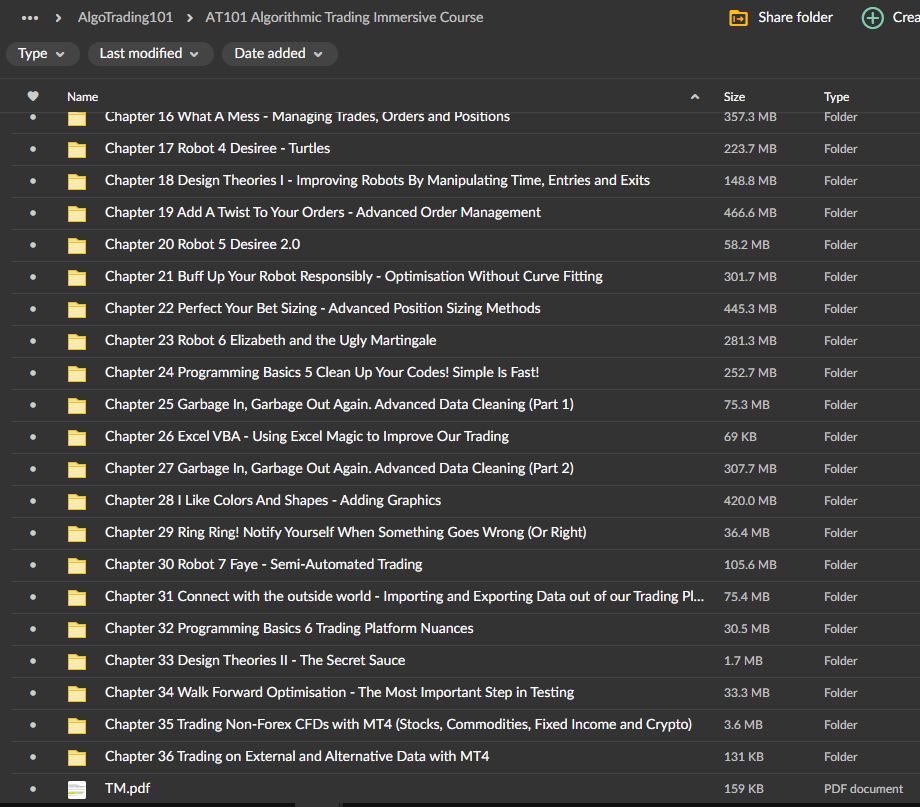

AT101: Algorithmic Trading Immersive Course

Chapter list (along with learning objectives for each chapter)

AT101: Algorithmic Trading Immersive Course

Chapter list (along with learning objectives for each chapter)

- Here’s What You Are In For!

- What is an Algo Trading Robot, its key traits and code structure

- What makes a successful Algo Trader

- How to set up and navigate your infrastructure/coding software

- Programming Basics 1: Variables and Conditional

- Basics of our coding language (MQL4)

- Syntax, Variables, Operations and Conditional Expressions

- Robot 1: Adeline – Our First Robot!

- Background to Forex markets, chart reading, basic indicators

- Coding Adeline together

- Testing Adeline using past data

- Brief look at modelling quality

- Uncommon Common Sense. Design Effective And Logical Robots

- Overview of our Strategy Development Guide

- Preliminary Research

- Backtesting

- Optimisation

- Live Execution

- Pros and Cons of an Algo Trading Robot

- Mathematical Expectations of our robots’ performance

- Overview of our Strategy Development Guide

- Garbage In, Garbage Out. Understanding Data

- Data Sources and Storage

- A look at the importance of data cleanliness

- Cleaning data (basic)

- Bad ticks, inaccurate testing and market tricksters

- Programming Basics 2: Loops

- Learning how to code loops

- Practice Exercises for Loops

- Robot 2: Belinda – Utilising Volatility!

- Our first measure of volatility (ATR)

- Introducing Belinda, the improved version of Adeline

- Coding and testing Belinda

- To Buy Big or Small? Position Sizing and Money Management

- Understanding trade/bet size (how much to trade per position) using a coin flip game

- Designing a bet sizing algorithm based on account size

- Coding our bet sizing algorithm

- Robot 2A: Belinda Upgraded (No Gambler’s Ruin for Me!)

- Implementing our bet sizing algorithm in Belinda

- Where To Start? Idea Generation and Expectations

- Setting expectations for our robots based on our resources, personality, skill set, lifestyle and goals

- Understand the essence of a trading idea – Proxies and Relationships

- Sources of trading ideas

- A look at the different types of strategies

- Grading ideas – Introducing our framework for vetting ideas

- How to fight against big hedge funds

- Programming Basics 3: Functions, Time and Self-Learning

- Learn to learn programming

- Code errors and debugging

- Coding Functions

- Practice Exercises for Functions

- Relevant Statistics 101!

- Statistical significance and Law of Large numbers and their role in robot testing

- Deriving suitable minimum sample size for our backtests

- Understanding Robot Behaviour and Robustness: Backtesting!

- Ensuring code accuracy

- Types of market condition

- Testing for Robustness

- Period Robustness

- Timeframe Robustness

- Seasonal Robustness

- Instrument Robustness

- Testing our robots through intended and unintended periods

- Stress testing our robots through black swans

- The butterfly Effect – Backtest bias via start point selection

- Grading the performance of our robots

- Programming Basics 4: Arrays And Indicators

- A look at our mentality towards Indicators

- Math behind Indicators

- Coding Arrays and Indicators

- Robot 3: Clarissa – Playing with Time

- Understanding the Datetime data type

- Coding rules revolving date and time manipulation

- Introducing and coding Clarissa – our robot that uses time entries

- What A Mess – Managing Trades, Orders and Positions

- Order limitations by your brokers

- Coding our customised order function

- Multiple order management

- Modelling transaction cost, spreads and slippage

- Robot 4: Desiree – Trade like the Turtles

- The history of the Turtle Traders

- Introducing and coding a simplified turtle strategy

- Design Theories I – Improving Robots By Manipulating Time, Entries and Exits

- Profitability in different timeframes

- Deriving optimal stop loss levels

- Comparing the importance of entries vs exits

- Analysing asymmetrical long and short rules

- Add A Twist To Your Orders – Advanced Order Management

- Breakeven and trailing stops

- Hiding from your broker – Creating virtual stops and take profit orders

- Robot 5: Desiree 2.0

- Buff Up Your Robot Responsibly – Optimisation Without Curve Fitting

- Objective Functions, Robustness and Curve Fitting

- 10 Ways to minimise curve fitting (overfitting)

- Degrees of Freedom

- Parameter Robustness

- In and out-of-sample testing

- Optimisation Evaluation

- Perfect Your Bet Sizing – Advanced Position Sizing Methods

- Relationship between sizing and trading frequency

- Gearing up and down with volatility

- Impossible Trinity of Sizing – Relationship between Leverage, % Risked and Stop Loss

- First Principles of sizing – Building customised sizing algorithms

- Other types of sizing – Kelly Criterion, Martingales and Anti-Martingales

- Robot 6: Elizabeth

- Programming Basics 5: Clean Up Your Codes! Simple Is Fast!

- Clean and robust coding

- MT4 Global Variables

- MQL4 Libraries

- Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 1)

- Creating custom timeframes

- Clean data, biased output

- Excel VBA – Using Excel Magic to Improve our Trading

- Excel trading game

- Syntax

- Conditional statements

- Loops

- Garbage In, Garbage Out Again. Advanced Data Cleaning (Part 2)

- Data time zone manipulation

- Defining “clean enough” data

- Scanning for errors

- Advanced data cleaning methodologies

- I Like Colors And Shapes – Adding Graphics

- Creating a Dashboard: Graphics and Labels

- Creating trendlines and levels

- Ring Ring! Notify Yourself When Something Goes Wrong (Or Right)

- Coding smartphone notifications

- Notify yourself during trade or price events

- Robot 7: Faye – Semi-Automated Trading

- Connect with the outside world – Importing and Exporting Data out of our Trading Platform

- Read and write information to Excel

- Build a spread logger

- Programming Basics 6: Trading Platform Nuances

- Perfecting the little coding details

- Understanding trading and backtesting nuances

- Design Theories II – The “Secret Sauce”

- Prudence-Behavioural Framework

- Alpha 1: Data

- Alpha 2: Global Macro

- Alpha 3: High-Frequency Trading

- Alpha 4: Market Microstructure

- Hybrid Model – Semi-Algorithmic Trading

- 5 Realities of Algorithmic Trading

- Crowd Behaviour – Outwitting the Masses

- Walking Forward – Advanced Optimisation

- Walk Forward Optimisation

- Performance patterns, consistency and seasonality

- 3D Parameter space evaluation

- Trading CFDs

- Looking Outwards – Trading On External Info and Alternative Data

- Trading using volume

- Feeding external data into MT4

- Trade on external events

- Robot 8: Gwen

- Cash Is King! – Running Robots With Real Money

- Paper versus Live trading

- Minimum Capital Determination

- Broker Selection

- Virtual Private Servers

- Downtime Prevention Protocol

- Hedging issues

- Strategy Monitor – Updating our robots regularly

- Live walk-forward optimisation

- Investor Marketplace

- Watch Her Well – Monitoring Your Robot(s)

- Operational Risk Management

- Monitoring our robots

- When to manually intervene

- Reviewing performance

- Understanding Trading Psychology – Emotions during drawdowns

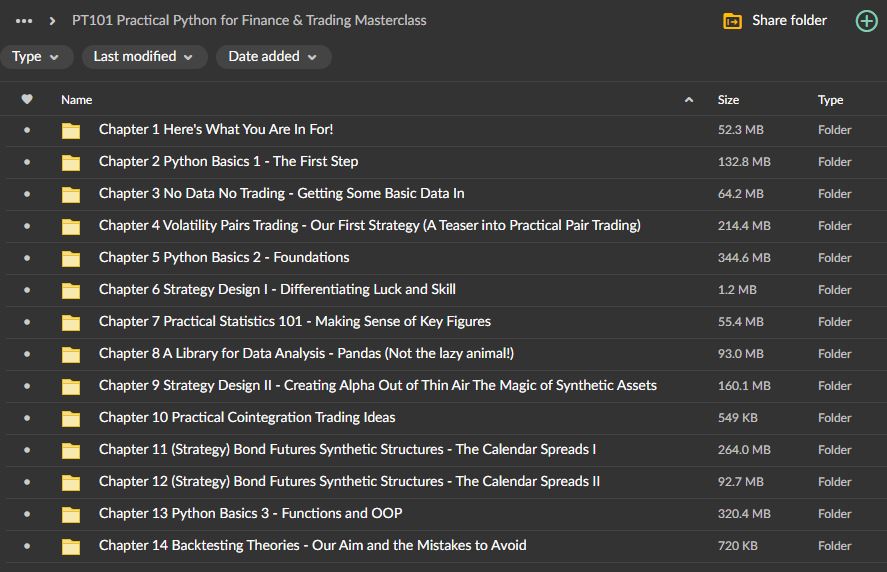

PT101: Practical Quantitative Trading with Python Masterclass

(In progress, we are still adding content)

Practical Strategies for Modern Markets

Basic Python and Test Strategies

- Just enough Python to get you started (we will learn more advanced Python techniques in the later part of the course)

- Designing a simple pair trading test strategy to whet your appetite and give you an rough sense of what to expect

Cointegration (Mean reversion: When A and B moves apart, we bet they will revert) (WE ARE HERE NOW)

- (Concept) Synthetic assets (ranging assets that are made by combining different assets)

- (Strategy) Bond futures calendar spreads and structures (creating ranging assets using bond futures)

- (Strategy) Market making using a proxy asset (entering and exit trades at the bid and ask prices)

- (Strategy) Statistical Arbitrage. Trading hundreds of stocks in a mean reversion manner.

Sentiment Analysis and Web API (Collect data from websites via special “links”)

- (Concept) Use Web API to collect data (eg. Google trends to analyse search traffic)

- (Strategy) Scour tons of stocks to see which stocks have sudden increase in search traffic volume

Alternative Data (Non-price data like Credit card, Location data etc)

- (Strategy) Use paid alternative data from vendors to analyse stocks

- (Strategy) Create your own special index by combining different alternative data (eg. combine retail receipts + foot traffic + search traffic to create a special index to predict retail stock prices. Live eg: MongoDB tracker, Crypto Tracker)

- (Strategy) Creatively find data on websites and scrape them to predict market moves

Correlation (If A moves, trade B)

- (Concept) Understand the statistical methods to test correlations

- (Strategy) Use Google search data, job listings and other scrapped data to predict stock and spread movements

- (Strategy) Use synthetic assets to predict other synthetic assets

Sentiment and Text analysis (Machine Learning)

- (Concept) Evaluate the sentiment of a particular phrase, sentence, paragraph or article

- (Strategy) Analyse tons of news articles in different language to find out the market sentiment towards an asset

Sales Page: Link

Reviews

There are no reviews yet