Description

Hello and welcome to Mentorship Traders. It took me over 13 years to design and deliver something like this – a continuous program for those who wish to trade and invest for an active or passive source of income. My objective with this program is to share my knowledge and experience about financial markets and trading that I have gathered since 2002. And also, to make you realize that becoming a better trader is more important than chasing money.

Mentorship Course Structure

A Perfect Blend Of Recorded Content And Live Mentoring Classes

The learning at Mentorship Traders happens in a mix of two ways – by watching videos which cover all concepts, techniques and strategies and then with live mentoring classes, thrice a week.

COURSE CURRICULUM CONSISTS OF THE FOLLOWING 3 MODULES

Basic Technical Analysis9 Chapters

This is the first step for anyone who wants to learn technical analysis from the very basics. You will have access to over 10 hours of content covering concepts from philosophy of technical analysis to use of Fibonacci tools which is used to derive price supports, resistances and targets. Check the “Quick View” below to get an exhaustive idea of what all will be covered in this module.

Chapters: Quick View

1. Introduction & Philosophy of Technical Analysis

2. Support & Resistance

3. Candlestick Analysis

4. Heiken Ashi Candlestick & Trading Strategy

5. Classical Price Patterns

6. Gap Theory

7. Indicators & Oscillators

8. Fibonacci Analysis

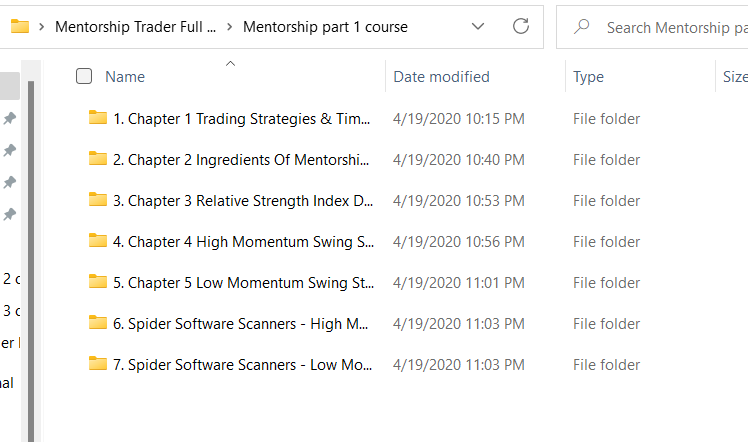

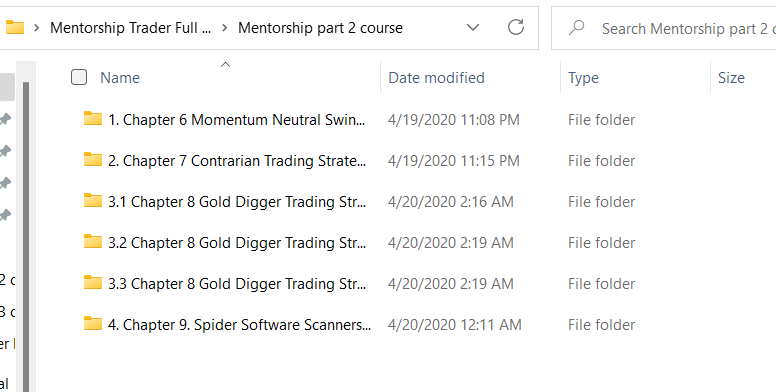

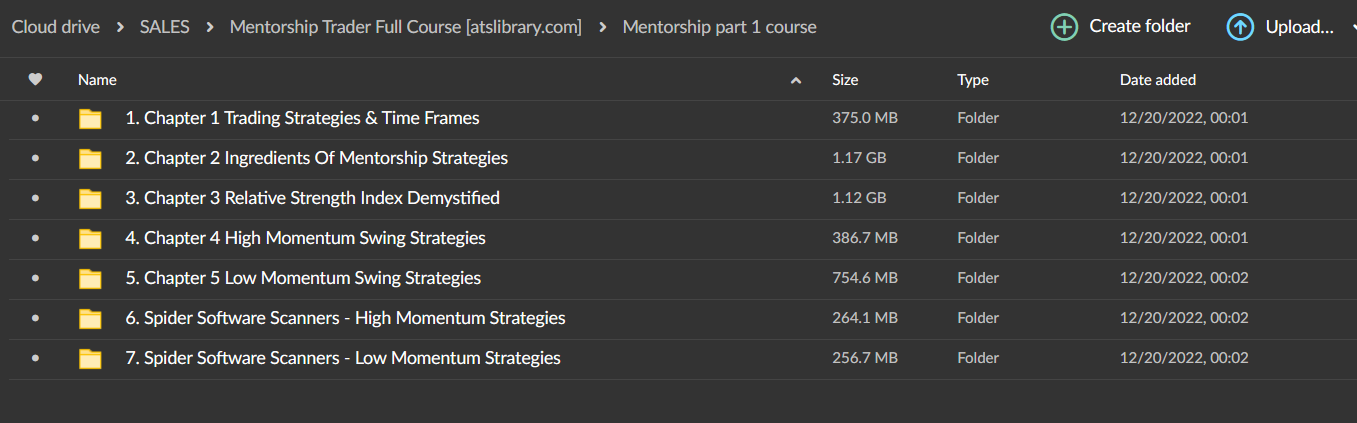

Trading & Investment Strategies11 Chapters

This section is designed for traders with both short-term & long-term strategies in mind. You will get access to videos which will cover concepts of various trading setups applicable in any time frame. We will also discuss “Habitual Investing” with concepts like ETFs and Mutual Funds. Check the “Quick View” below to get an exhaustive idea of what will be covered in this module.

Chapters: Quick View

1. Trading Strategies & Time Frames

2. Ingredients of Mentorship Strategies

3. Relative Strength Index Demystified

4. Breakout Strategies

5. Contrarian Strategies

6. Swing Strategies

7. Money Management

8. Trading Psychology

9. Different Types of Investing

10. Exchange Traded Funds

11. Mutual Funds – A Discussion

12. Recordings – Live Mentoring Classes

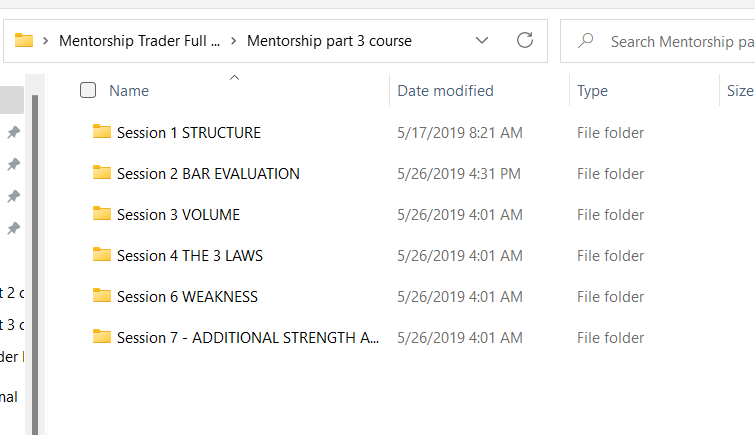

Option Strategies7 Chapters

This section is designed for a practical understanding of Options trading. Many people find options difficult, but I will say they are not difficult but different. Our approach with options is more from a practical aspect with a clear understanding of which strategy one should adopt and when. Check the “Quick View” below to get an exhaustive idea of what will be covered in this module.

Reviews

There are no reviews yet